In 2025, shipments of smartphones will increase by 2% worldwide, with Apple dominating the market.

According to a recent analysis from Counterpoint Research, the global smartphone market resumed modest growth in 2025, with shipments rising by roughly 2% annually. This indicates that demand for mobile devices is resilient even as the market matures and represents two years in a row of recovery following a period of stagnation.

A Market Bouncing Back

The worldwide smartphone market was able to develop in 2025 after a few years of sluggish growth. According to Counterpoint’s analysis, robust demand for high-end smartphones, rising 5G adoption in developing nations,

and better economic conditions in important countries were the main drivers of this development.

Although the 2% increase in shipments isn’t a sharp increase, it does indicate consistent underlying strength, particularly in light of persistent issues like regional market saturation and growing component costs.

Apple at the Top

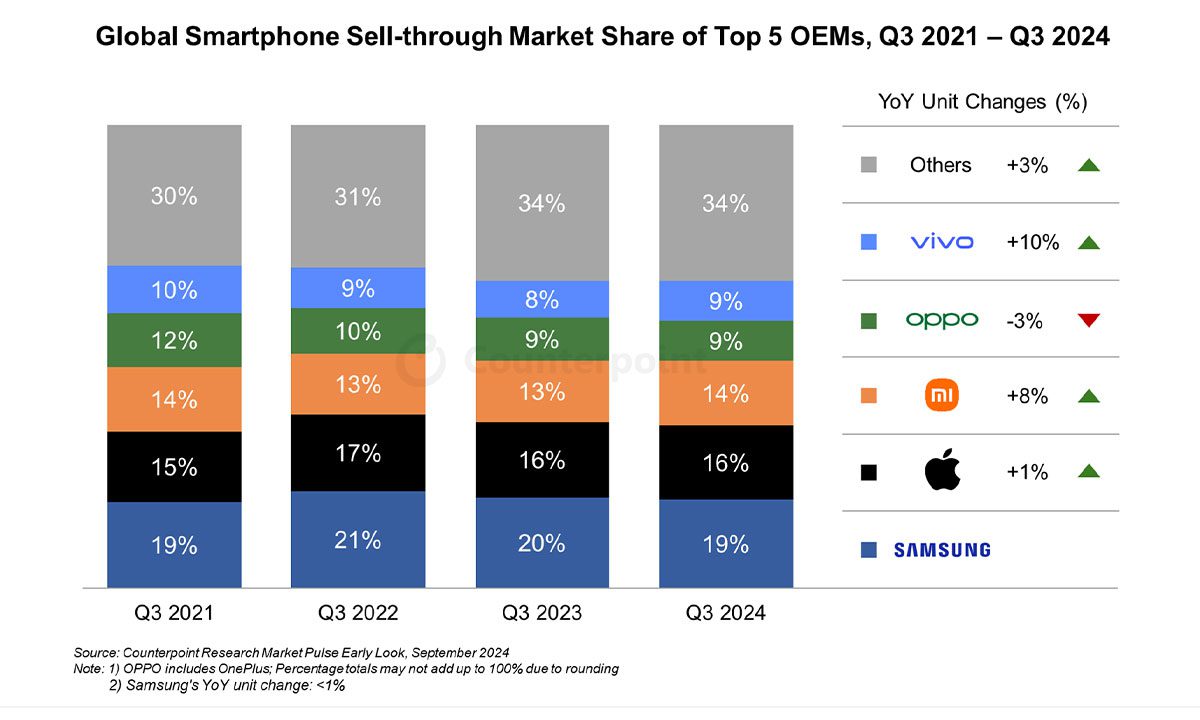

Apple’s dominance in the worldwide smartphone market is one of the report’s main highlights. Apple accounted for 20% of global shipments in 2025, the highest percentage of any brand that Counterpoint analysed. Strong demand for the iPhone 17 series and strong sales in both developed and developing markets contributed to that performance.

Additionally, Apple’s shipments increased by double digits year over year, surpassing those of its nearest competitors. Analysts point out that the company’s approach of providing a wide range of gadgets at different price points, along with financing options in certain areas, helped maintain consumer interest.

Where Other Brands Stand

With a 19% shipment share, Samsung was in second place thanks to consistent results from all of its Galaxy models. Both flagship and mid-range models contributed to its year-over-year growth, which was more moderate but steady.

With almost 13% of the market, Chinese maker Xiaomi remained in third place, demonstrating the ongoing desire for its products, especially in areas with robust mid-range smartphone sales. Even while their volumes didn’t approach those of Apple or Samsung, other companies like Vivo and Oppo also helped the market as a whole grow.

What’s Driving Growth — and What’s Next

Two key trends helped fuel the 2% rise in shipments:

- Demand for premium devices: Due in part to new features like improved cameras, 5G connectivity, and improved performance, many customers upgraded to more expensive phones.

- Emerging market momentum: As 5G infrastructure grows, countries in Asia, the Middle East, and Africa demonstrated above-average demand for smartphones.

Analysts at Counterpoint, however, also warn that the market may encounter difficulties in 2026. Shipments of smartphones may be under pressure next year due to ongoing chip shortages, growing component costs, and a shift in semiconductor production towards high-end AI data centre chips.

Looking Ahead

Although the smartphone industry is happy about the rise in 2025, it is a little in comparison to past trends. In an era where innovation cycles are slowing and handset replacement cycles are prolonging, the market’s future performance will probably depend on how manufacturers handle supply restrictions, price pressures, and consumer demand.

Overall, the 2% increase in 2025 provides a glimpse of a market that is stabilising while adapting to changing technological trends and economic realities. Depending on how these more general issues develop, that momentum may continue into 2026.

Views: 106